how much taxes are taken out of a paycheck in ky

For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. However they dont include all taxes related to payroll.

Kentucky Paycheck Calculator Smartasset

Employers also have to pay a matching 62 tax up to the wage limit.

. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS. Kentucky Salary Paycheck Calculator.

Both employers and employees are responsible for payroll taxes. Taxes Federal Income Tax. 0765 for a total of 11475.

Get Your Max Refund Today. Take Home Pay for 2022. Social Security withholding is 62 of your income while Medicare withholding is 145 of your income each pay periodIncome Tax Brackets.

The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate system during a tax reform in early 2018. FICA taxes are commonly called the payroll tax. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

A 2020 or later W4 is required for all new employees. How much is my paycheck if I make 50000. After a few seconds you will be provided with a full breakdown of the tax you are paying.

KENTUCKY INCOME TAX 2021 WITHHOLDING TAX TABLES COMPUTER FORMULA Revised December 2020 Effective for Tax Year Beginning January 1 2021 Commonwealth of Kentucky DEPARTMENT OF REVENUE Frankfort 42A003T. Switch to Kentucky hourly calculator. Kentucky Hourly Paycheck Calculator.

If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. The average taxpayer gets a tax refund of about 2800 every year. If you increase your contributions your paychecks will get smaller.

How much taxes does Virginia take out of your paycheck. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. Posted by 5 years ago.

This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. But the income threshold for the low levels of taxation is very low.

Amount taken out of an average biweekly paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

Income Tax Calculator California If you make 50000 a year living in the region of California USA you will be taxed 10417. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

What percentage of my paycheck should be withheld for federal taxes. The income tax brackets in the state of Kentucky are fairly narrow ranging from 2 percent for the lowest income workers to a high of 6 percent. This is because they have too much tax withheld from their paychecks.

Amount taken out of an average biweekly paycheck. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. For members who have made taxed contributions to KPPA and elect to receive monthly benefits current Internal Revenue Service regulations provide that the amount of after-tax dollars in the account be recovered by making a portion of each monthly benefit non-taxable.

When deciding whether taxes should be withheld or reduced from your payroll they will take all those aspects into account. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Regardless of their filing status Kentuckians are taxed at a flat rate of 5.

These amounts are paid by both employees and employers. Paycheck Deductions for 1000 Paycheck. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Up to 32 cash back Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Total income taxes paid.

FICA taxes consist of Social Security and Medicare taxes. Your average tax rate is 305 and your marginal tax rate is 431. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Workers in Kentucky who earn 8000 or more are in the 58 percent tax bracket of their wages in the form of state taxes. For example a person that gets a 1000 paycheck every week will be taxed differently compared to someone that gets a 1000 paycheck every month.

We hope you found this salary example useful and now feel your can work out taxes on 38k salary if you did it would be great if you could share it and let others know about iCalculator. What Do Small Business. For any wages above 200000 there is an Additional Medicare Tax of.

We depend on word of mouth to help us grow and keep the US Tax Calculator free to use. FICA taxes consist of Social Security and Medicare taxes. That means that your net pay will be 69540 per year or 5795 per month.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The Medicare tax rate is 145. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Monthly benefits from KERS CERS and SPRS are subject to federal income tax. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. You also have to pay local income taxes which Kentucky calls.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. Your filing status will also change the way your taxes are withheld. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Payroll Software Solution For Kentucky Small Business

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Payroll Software Solution For Kentucky Small Business

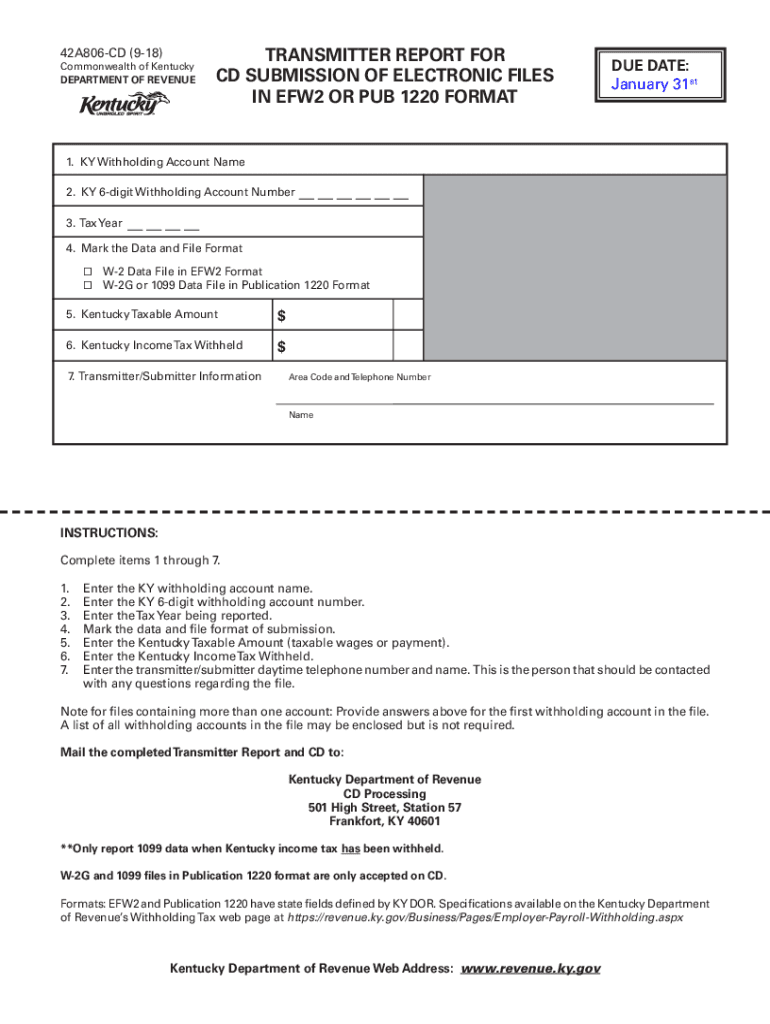

Ky Dor 42a806 2018 2022 Fill Out Tax Template Online Us Legal Forms

Payroll Software Solution For Kentucky Small Business

Paycheck Calculator Kentucky Ky Hourly Salary

Kentucky Income Tax Calculator Smartasset

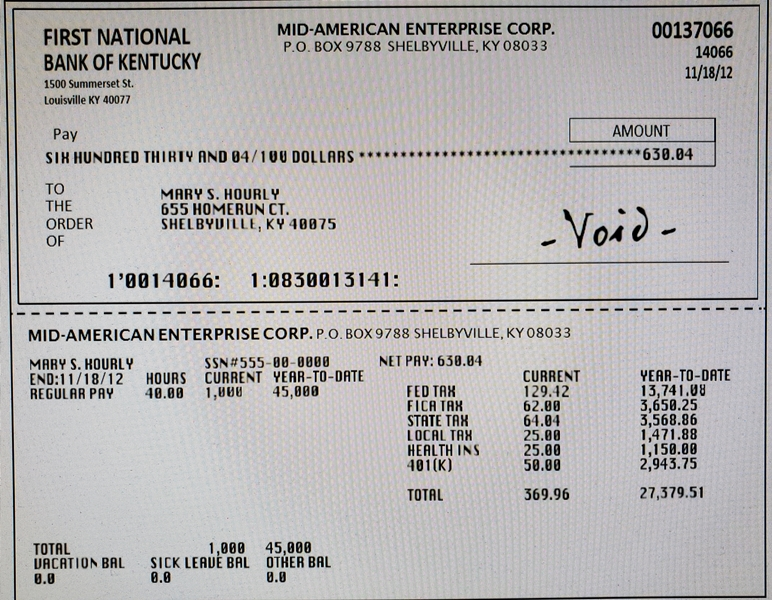

Solved Look At The Check Below And Answer The Following Chegg Com

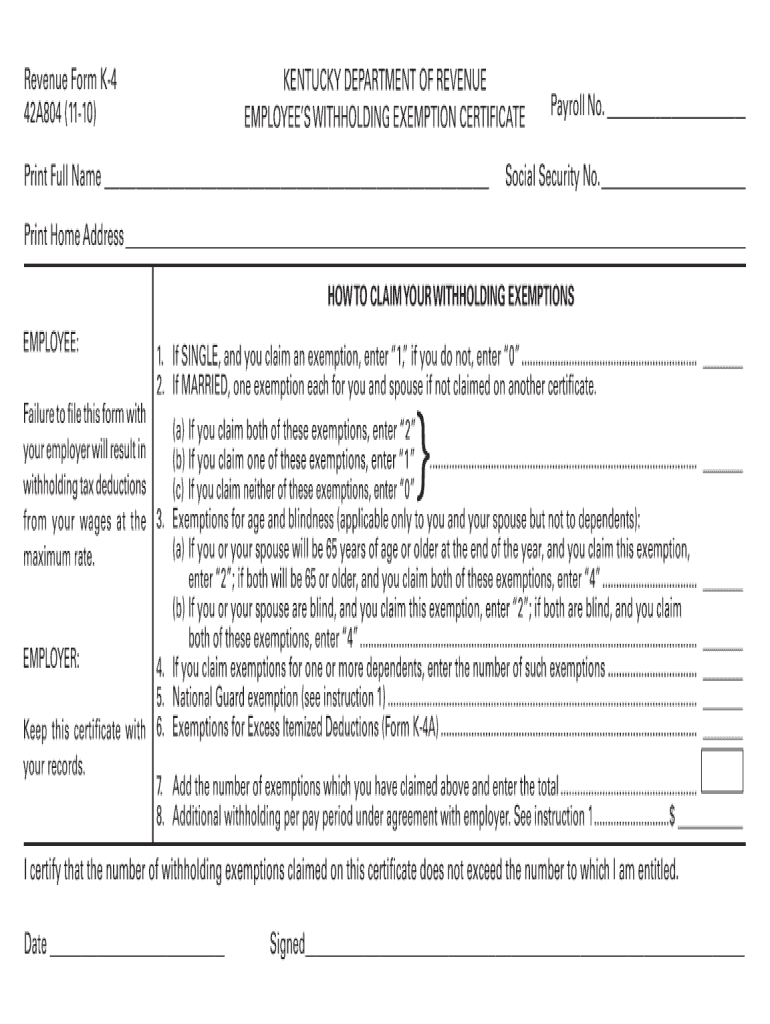

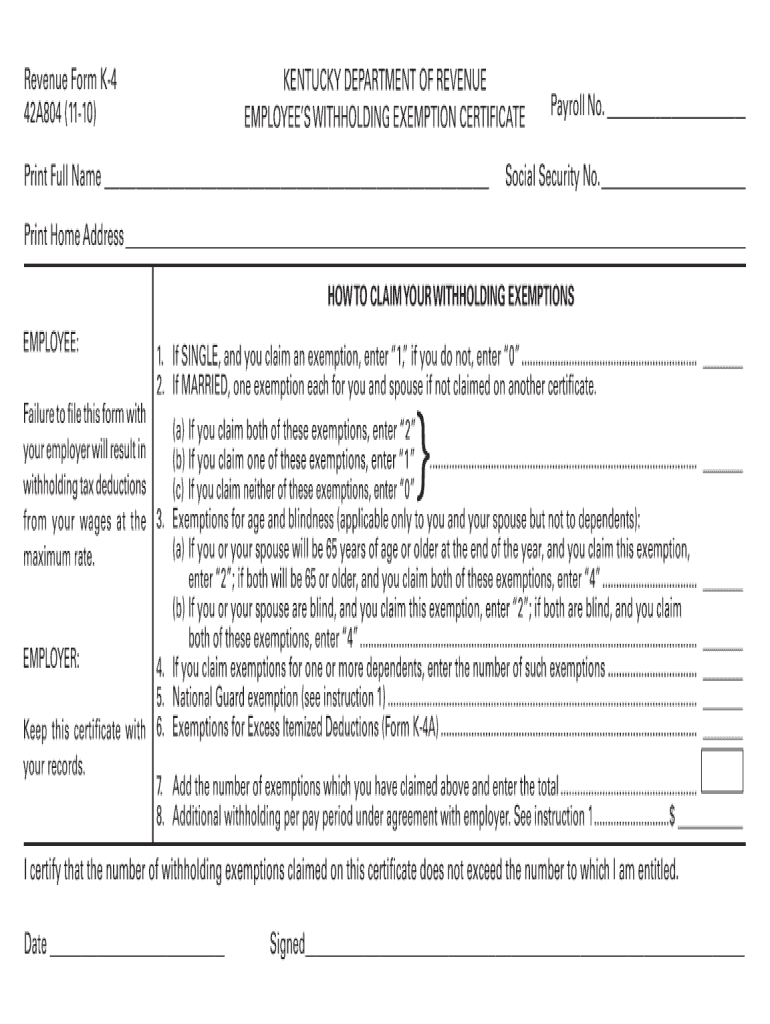

Ky Dor 42a804 Form K 4 2010 Fill Out Tax Template Online Us Legal Forms

Matheus Prado Payday Docx 1 Gross Pay Is The Total Of What You Ve Earned What Is This Employee S Gross Pay For The Period Covered By This Course Hero

2022 Federal State Payroll Tax Rates For Employers

Welders Cutters Solderers And Brazers Salary In Louisville Ky Comparably

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Free Kentucky Payroll Calculator 2022 Ky Tax Rates Onpay

Ppp And Other Pandemic Tax Moves To Make In March 2021 Don T Mess With Taxes

Peoplesoft Payroll For North America 9 1 Peoplebook

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings